Whenever you are faced with a bad credit score, it can often be quite discouraging, especially if you are in urgent need of funding. After all, most traditional financial institutions tend to be reluctant to provide any form of credit to a borrower with a less-than-stellar credit history.

However, this doesn’t necessarily mean that there are no alternative options available to you either. There are UK loans for people with bad credit that you can apply for online within a matter of minutes, all from the comfort of your own home.

As such, we are going to quickly break down one of the top loan services in the country, UKBadCreditLoans. It is a company that has successfully built a positive reputation for providing excellent financial services to numerous online borrowers that find themselves in unpleasant situations.

So, let’s get started, shall we?

Table of Contents

What Is UKBadCreditLoans All About?

UKBadCreditLoans is an online lending platform that essentially helps people find reliable and trustworthy lenders for bad credit. It is not to be mistaken for a direct lender that provides funding, but instead, it acts as a loan matchmaker that instantly connects borrowers with potential loan providers.

UKBadCreditLoans co-founder Emilia Flores went on to add, “We have over 100 lenders within our network, most of whom are prepared to review loan applications from anyone with a bad credit score.” This makes it the ideal service to rely on whenever banks and credit unions are unwilling to consider your loan request.

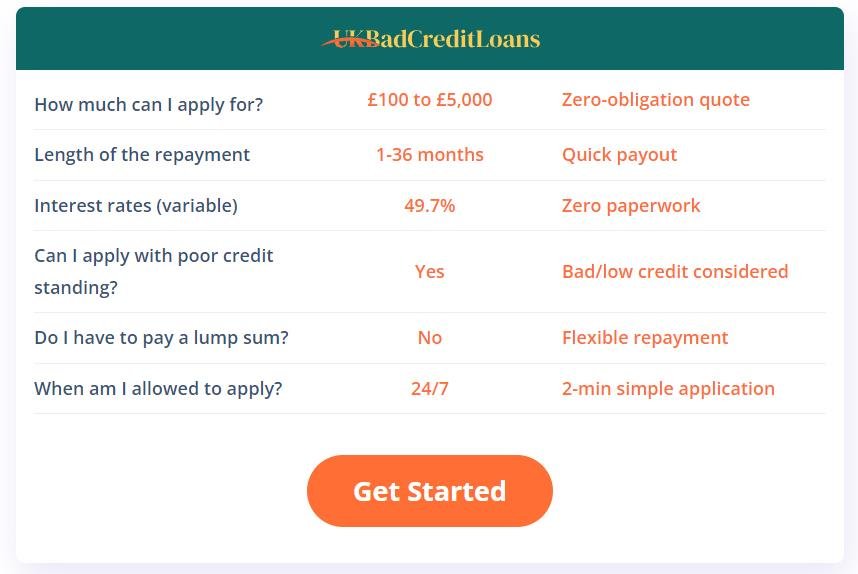

The platform can also be relied upon to provide users with access to a wide variety of loans, such as payday loans, short-term loans, quick loans, same-day loans, and more. On top of that, borrowers can access loans starting as low as £100 to £5,000, with loan terms that typically range between 1 month and 36 months and interest rates that can vary up to 49.7%.

However, do keep in mind that the loan amount, terms, and rates that you end up qualifying for will often vary depending on your credit score, income level, as well as lender.

Things To Consider When Using UKBadCreditLoans

Before you decide to accept a loan from UKBadCreditLoans’ lending network, it is vital that you take into consideration a few important things: the loan’s interest rates and fees, and the repayment terms.

#1. Interest Rates and Fees: The first thing to look at is the interest rate that the lender is offering before you make a final decision. After all, some forms of financing, such as payday loans, tend to come with extremely high interest rates that can be difficult to repay.

Furthermore, some lenders end up charging extra costs, such as origination fees or pre-payment fees. As such, you should always take your time to compare the offers available to you in order to secure yourself the best deal possible.

#2. Repayment Terms: Another factor to consider is the loan’s repayment terms, as you should always choose the lender that can provide you with a reasonable amount of time to pay back the loan. However, you should also keep in mind that a longer repayment period does not necessarily translate to a good deal. In fact, the longer the repayment period is, the more interest you will typically end up paying over time.

Failure to consider these factors can lead you to accept a loan offer that you are not able to afford and increase the risk of you ending up in bad debt, so make sure to always read through any offers and their fine print in full.

Why Should You Choose To Use UKBadCreditLoans?

The good thing about using UKBadCreditLoans is that it comes with a wide variety of unique benefits that most other lending services typically fall short on. These include:

- Speedy Lending Process: Unlike most lending services, UKBadCreditLoans does not require you to submit an excessive amount of documents or wait days to receive a decision, let alone your funds.

The online application form often takes just a few minutes to complete, and since the initial loan review process is automated, you can expect a decision on your application within minutes. Plus, all approved funds are typically deposited by the next business day.

- High Approval Rates: UKBadCreditLoans’ partner lenders are open to accepting borrowers of all credit types, so even if your credit score is less-than-stellar, you can still secure a cash loan. This is because their lending network will usually take other factors besides your credit score into consideration when evaluating your application. Some of the factors include income level, employment status, debt-to-income ratio, etc.

- Multiple Loan Options: Since UKBadCreditLoans works with an extensive network of lenders, this also allows borrowers to easily access a wide variety of loan products. Some of the most popular ones include payday loans, bad credit loans, same-day loans, short-term loans, and more.

And given that each of these loans comes with its own rates, terms, and repayment policies, you can easily find the one that best fits your budget and financial situation.

- No Fees Required: UKBadCreditLoans does not charge users any fees to use its services. This means that anyone who meets their eligibility criteria can submit a loan request with their partner lenders without having to pay anything or sign up for an account.

How To Get Funding via UKBadCreditLoans

As mentioned before, UKBadCreditLoans does not charge users any fees to use their platform, but you still need to meet a few basic eligibility criteria to successfully apply.

This means:

- Being a legal citizen/resident of the UK

- Being at least 18 years old

- Having a steady income stream, i.e. business or job

- Having an active checking account

If you meet the above requirements, you can follow the steps below to get started on securing a loan with their lending network.

Step 1: Fill out the online form

When you land on the homepage of UKBadCreditLoans’ site, you will need to select the loan amount that you want to apply for and fill out a complete online pre-approval form. This will mean sharing your personal and financial information such as your bank account details, credit score, contact details, social security number, etc.

Step 2: Compare loan offers

Once you submit the form, a decision on your application will be made within minutes, and if approved, you will receive loan offers from different lenders. Each offer will come with its own rates, terms, and conditions, so you will need to carefully review the information to choose the most favorable one.

Step 3: Receive Your Funds

If you decide to accept an offer, you will need to e-sign it, at which point the lender will process your funds and have them deposited into your checking account by the next business day. However, always make sure that you can afford to make the repayments on the loan before accepting it; otherwise, defaulting could result in penalties or even being reported to the relevant credit bureaus.

Conclusion

When traditional lenders like banks and credit unions are unwilling to grant you a loan, you should consider turning to UKBadCreditLoans as an excellent alternative.

The service is free to use, offers access to fast cash loans even with bad credit, and doesn’t have any lengthy loan application procedures either.

It is also commendable that it has a wide variety of loan options to choose from, which enables you to choose the right form of financing to quickly resolve your financial woes.

Plus, with all their partner lenders being fully vetted and regulated by the Financial Credit Authority, you should be able to access fair and reasonable loan rates and terms. All this taken into consideration makes the lending service worth checking out.