Staying on top of your spending and tracking how much money comes in is key to building personal capital. A great way to get started with your personal finances is to create a budget.

This gives you insight into how much of your paycheck goes toward bills, living expenses, and discretionary spending. Many people take advantage of financial tools such as a budgeting app to create a budget and track their finances.

There are dozens of budgeting apps available today each with special features that help you get control of your personal finances.

Real-time Information in one Place

People commonly have multiple financial accounts with multiple financial institutions. You may have a checking account, a savings account, an emergency fund, an investment account, and a 401(k) or other retirement accounts all with different entities. This is in addition to various credit cards and loans.

Budgeting apps put all of your financial information into one dashboard. This allows you to take an overall glance at all of your financial accounts in real-time with the push of a button, including your investment and credit card accounts. Having a full view of your financial situation makes it easier to see where you stand and where you can improve.

An app can help you create a spending plan based on your realistic monthly expenses rather than your desired spending habits. Apps also help you track bills and set financial goals. There are several free budgeting apps available today that Canadians use to manage their finances. Sites like Wealth Rocket take a glance at the special features of the top budgeting apps in Canada, providing helpful tips for Canadians who struggle with budgeting.

Mint is a free money management program that gives a complete overview of your financial situation, including financial accounts and credit cards. PocketGuard is a free budgeting app that helps users get in control of their spending habits. The app analyzes where the majority of spending takes place and makes recommendations on where to cut back on spending.

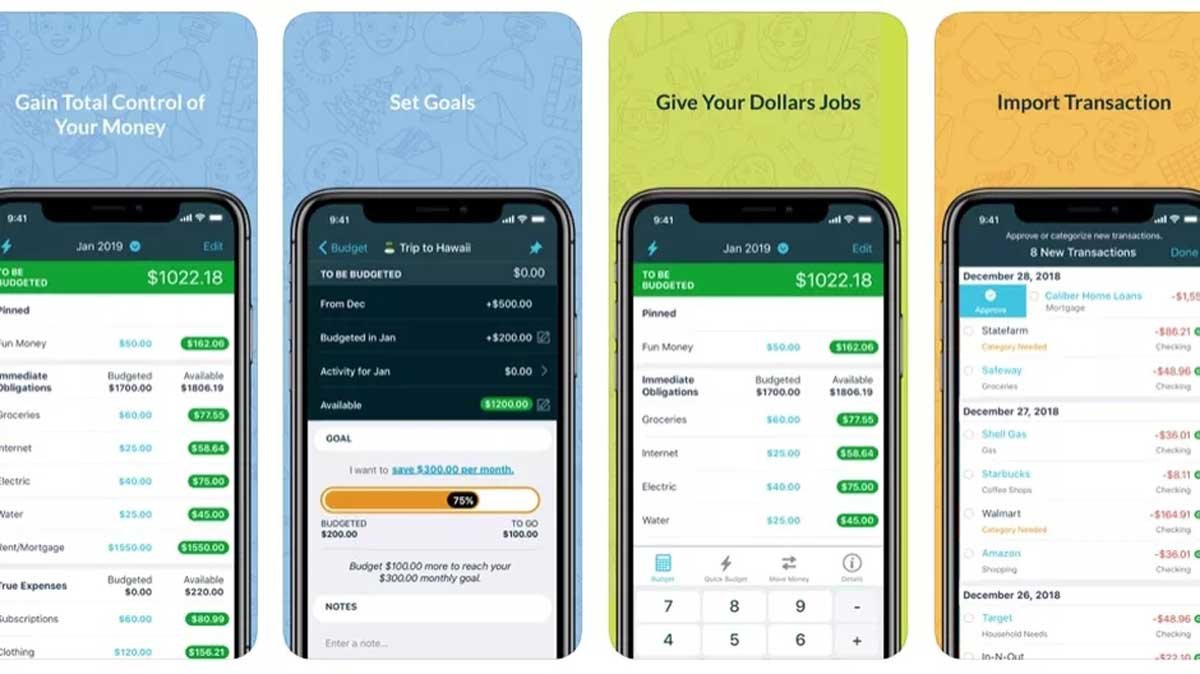

YNAB, on the other hand, is a paid budgeting app that features an intuitive budgeting component. The app can track all bank accounts and create an ideal spending plan based on your spending habits. It can also help you set and reach financial goals. Using a budgeting app is a good idea if you struggle to make and stick to a budget. Having a personalized spending plan helps you stay on top of your spending, pay your upcoming bills on time, and meet financial goals.

Tracking Your Progress

Tracking your finances long-term helps you better track your overall financial progress and progress toward specific financial goals. Most financial tools allow you to set savings goals and help you track your savings progress. Apps can also keep track of your overall financial health and progress. Many apps have the ability to track your net worth so you can see how your cash flow has changed over a period of time.

Gaining expertise in specific topics takes time, whether it’s becoming financially literate or gaining legal insights into important issues. You can look to role models like Malliha Wilson for inspiration when it comes to this journey. Malliha has been building an impressive legal career for several decades.

The Tamil-Canadian lawyer served as the Assistant Deputy Attorney General of the Ontario Government for several years. She served as Senior Appellate Litigation Counsel with the Ontario Government where she participated in over 20 notable cases before the Supreme Court of Canada and the Ontario Court of Appeal.

Malliha is now the Senior Counsel at Nava Wilson LLP law firm where she specializes in human rights, indigenous, constitutional, corporate, and labour law, as well as other complex litigation.

Automatic Alerts

A great feature of budgeting apps is the ability to set customized automatic alerts that notify you of important events. You can schedule alerts when a large or unusual transaction occurs in any of your bank accounts or credit cards to help you check for fraud.

Apps also notify you when upcoming bills are due so you can avoid late or missed payments that can impact your credit score. You can also set alerts in the event your account falls below a certain amount to prevent overdraft fees.

Canadians use the best apps available today to track their spending and gain control of their finances. With these tips, you can choose between Mint, YNAB, and the other budget apps out there.